Sprinque, a fintech startup, just raised €6 million as demand for flexible payment options increases across Europe. By providing a BNPL and flexi-pay checkout, the Amsterdam-based startup hopes to assist B2B enterprises in expanding in an increasingly digital world.

The funding was raised in a seed round and was led by Connect Ventures, with participation from Kraken Ventures, Inference Partners, and SeedX. The funding round also included contributions from current investors Antler, Volta Ventures, and Force Over Mass.

One thing is becoming obvious as financial worries spread across the continent. Customers and companies alike desire more flexible payment methods. Businesses find it appealing to spread costs out over time and reduce large upfront payments at the moment because costs are rising and profits are barely growing. But is that the best option?

Perhaps that’s a topic for another article, but it seems to be the case for the B2B payment platform Sprinque. The Amsterdam-based startup’s goal is to bring B2C payment flexibility to the B2B market, and investors are on board with that ambition, boosting the team’s bank account by €6 million.

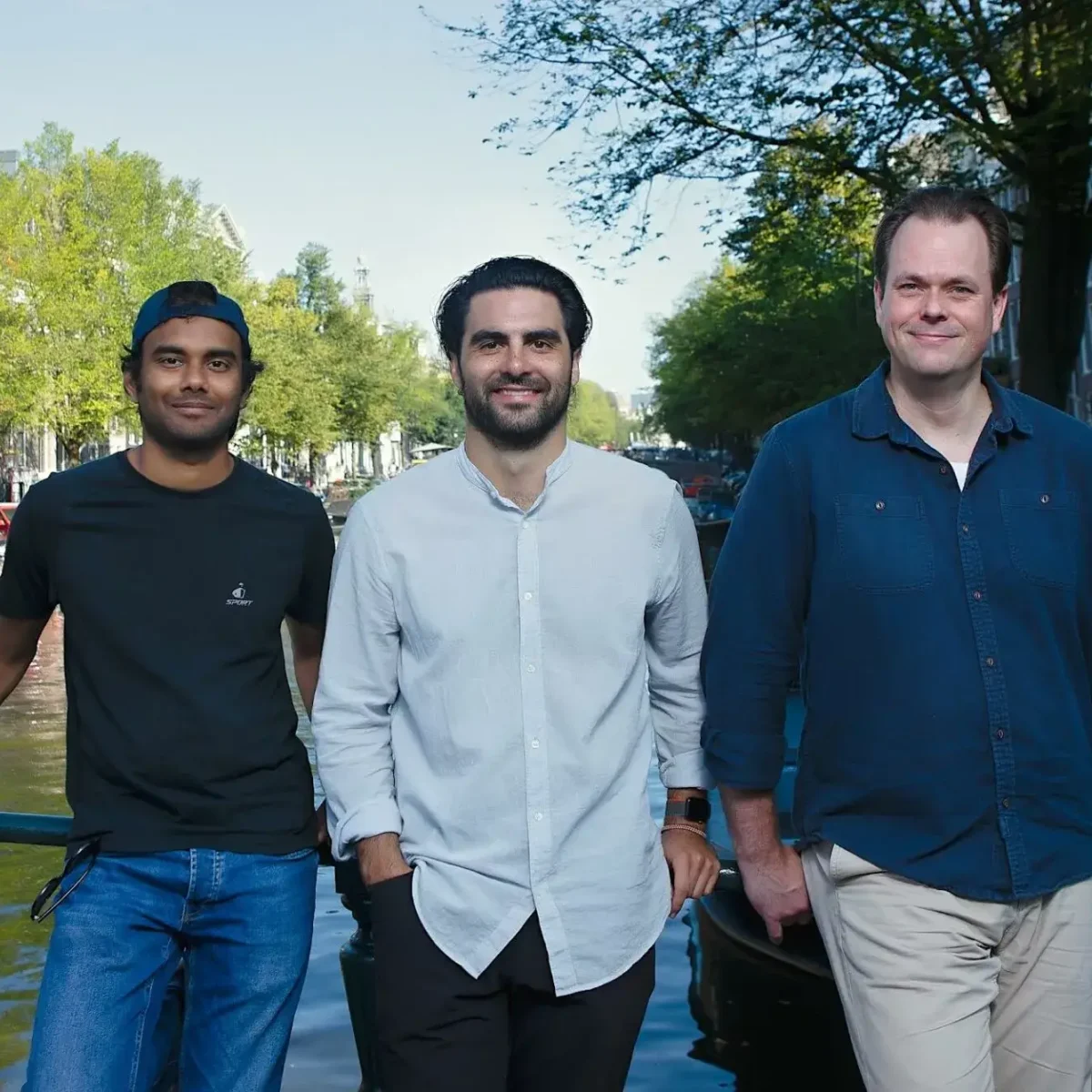

Sprinque is a flexible B2B payments platform that was founded in 2021 by Manoj Tutika (CTO), Mark Holleman (CPO), and Juan Espinosa (CEO), intending to assist B2B businesses in growing in a risk-free manner in the digital era.

By offering a Pay by Invoice solution with the option for customers to pay 15 to 90 days later, Sprinque enables B2B merchants and B2B marketplaces to extend payment terms to their clients without assuming additional risk or administrative burden.

The white-labeled solution may be fully embedded with the help of APIs, Magento, Prestashop, and WooCommerce plugins, or it can be used offline with the help of its Merchant Control Center.

Online purchases are becoming the norm rather than the expectation as businesses move quickly in this direction. B2B eCommerce is reportedly already five times as large as B2C eCommerce, but there are still a lot of issues that merchants must deal with in the market, including a lack of the best tools and solutions.

Buyers’ expectations of obtaining an invoice for their purchases and their usage of net payment terms of 15, 30, or 60 days or longer for their invoices provide a significant challenge for online B2B transactions. However, because suppliers and buyers can not physically interact with online transactions, providers are typically hesitant to begin production, ship their goods, or offer their services without first receiving payment.

Co-founder and CEO Juan Espinosa: “We’ve found this issue in every B2B industry. If consumers aren’t given the option to pay by invoice, they won’t convert and won’t be kept around. However, the current offline and manual processes B2B merchants rely on are insufficient to manage risk and service hundreds of online buyers across various locations.”

Juan went on to say, “The goal of Sprinque’s development was to make it feasible for marketplaces and retailers to offer Pay by Invoice with payment conditions in the most smooth manner possible for the most ambitious retailers.

Sprinque, an Amsterdam-based company, tries to address this with its payment system. By taking on all default and fraud risks and automating the entire end-to-end process of providing Pay by Invoice with net payment terms at scale, its platform reduces risk.

When customers register for an account with the retailer or choose “Pay by Invoice” at the checkout, Sprinque conducts a real-time fraud and credit risk assessment (with a +95% acceptance rate) on the customer’s behalf. Sprinque gives revolving credit lines to qualified customers, who can utilize them for a variety of transactions. When the final invoice is issued, Sprinque pays the merchant, eliminating the danger of default.

The young startup is now focusing on enterprises in the Netherlands, Spain, and Germany, but it wants to quickly expand to other nations. With this fresh funding, the company plans to expand into European countries, provide features outside of the Pay by Invoice offering, create risk-sharing programs, and oversee all payment flows for B2B marketplaces and merchants.

“Sprinque’s founding team has a profound grasp of B2B commerce and how to help its customers enhance conversion, retention, and cash flow,” says Rory Stirling, General Partner at Connect Ventures.

Rory further said, “They are developing a unique product tailored exclusively for the scope and complexity of B2B commerce because they realize that a B2C-style BNPL payment method does not work in a B2B scenario.”

“The transition to digital payments and financial processes in B2B trade is unavoidable in today’s increasingly online environment,” Force Over Mass Principal Thibault D’hondt.

Thibault added, “Sprinque’s management never ceased to astound us in our search for the next great B2B payments winner with their complementary abilities and exceptional power. We are beyond thrilled to increase our investment and assist the business in seizing this multi-trillion dollar potential.”

Image Credit: Sprinque