Enpal, a Berlin-born unicorn startup has just completed a refinancing deal worth a total of €855 million. The startup has as its goal to give Europe a future powered by renewable energy as the business is currently among the fastest-growing in the energy industry.

A total of €855 million in debt financing was secured, of which €585 million in debt commitments came from BlackRock Alternatives, ING, Pricoa Private Capital (the private capital division of PGIM), and UniCredit, four of the world’s top investors. Enpal will be able to use the money more effectively thanks to two supplementary working capital facilities from ING worth €150 million.

In connection with this deal, the senior lenders have significantly raised their prior capital commitments to Enpal. Infranity, a Generali affiliate, signed further institutional commitments in the amount of up to €120 million in the form of a Holdco loan. Enpal’s entire refinancing commitments will now total about €1.4 billion as a result of this transaction.

We seem to hear about the developing and worsening energy crisis in Europe almost every day. Europe’s energy system is at a critical juncture due to growing prices, an expanding supply chain, and an ever-present climate issue. The need to switch to more reliable, dependable and environmentally friendly energy sources is now more urgent than ever across the continent.

There is no question that the use of renewable energy sources is the way of the future, and there are many possibilities accessible. The difficult part is to quickly and smoothly provide everyone on the continent with access to these sources.

Enpal, a company established in Berlin, seeks to contribute to this by hastening the energy transition using affordable solar technology. In the largest home solar financing to date in Europe, the company has now been able to source additional capital for its refinancing engine.

“We are thrilled to join with this wonderful set of banks and institutional investors again who support our objective to make green energy simple, inexpensive, and available to everybody,” says Mario Kohle, founder and CEO of Enpal. We rely on a strong network of financing partners to enable us to develop faster than anyone else in the industry, installing a few thousand new solar units each month, as we observe customer demand increasing steadily as more and more individuals adopt the model of energy independence.

Enpal, a unicorn startup from Europe, was established in 2017 to make it simpler for homeowners to transition to solar power. On a subscription basis, it offers a full solution that includes a solar system, energy storage, a green power price, and a smart home environment.

With solar power systems, energy storage, EV chargers, green electricity rates, and intelligent energy management, Enpal delivers the first complete package for a climate-neutral home. The company also offers an all-inclusive worry-free package and rents out the systems that democratize access to solar energy by removing the frequently exorbitant up-front charges.

Mario Kohle, the company’s founder and CEO, spoke with us earlier this year to discuss how he built the business into one of Europe’s fastest-growing energy companies. Currently, it serves over 30k clients and installs more than 2000 solar energy systems each month.

Viktor Wingert, the co-founder of Enpal and its chief investment officer, said: “Enpal wants to make green energy accessible for the majority and is leading a trend in Germany. Our ultimate goal is to create a large, renewable community made up of everyone who has a solar system on their roof, an electric vehicle parked in front of their house, and an energy storage system inside their residence.

Enpal is bridging the gaps in the solar energy value chain by purchasing directly from the biggest PV manufacturers, operating its own solar installer training center, and employing over 1,000 continuously hired installers and electricians. After the customer signs the contract, Enpal’s typical delivery period for a solar installation is roughly six weeks.

The company will be able to quicken the uptake of solar energy thanks to this refinancing, supporting Europe’s energy transition and paving the way for a more sustainable energy future.

In this deal, Greenberg Traurig supplied legal counsel to Enpal while ING served as Enpal’s financial advisor. Simmons & Simmons provided legal and transaction documentation advice, Everoze provided technical advice, and Marsh provided advice to the lenders (insurance due diligence). ING serves as Senior Agent, Account Bank, and Security Agent for both facilities, while UniCredit is hired as KfW Agent.

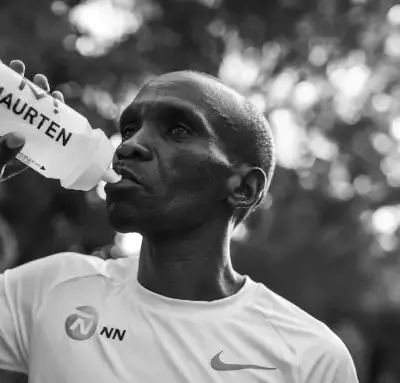

Image Credit: Enpal