Stockholm-based European SME lender, DBT, has raised a SEK 3.1 billion (~$285 million) debt facility from UK-based NatWest and Värde Partners. To date, this finance transaction represents the largest entry into the expanding Nordic SME loan market.

The fresh funds will allow DBT to keep up with small business demand for corporate loans that are focused on growth and innovation. According to the business, the present European energy crisis, rising gasoline prices, and inflationary spike have all had an impact on SMEs and raised demand.

“With the help of this significant financial arrangement, we can help even more scaling SMEs in Sweden. Given the present energy crisis, inflationary spike, and growing fuel prices, the SME companies we help feel an increased need for flexible yet long-term robust financing at this time, Alexis Kopylov, CEO and co-founder of DBT, said.

The expansion and success of SMEs, as well as their beneficial effects on the economy, depend on stable access to financing. By supporting DBT, we are taking a further step toward our goal of lowering obstacles to business growth. Olmo Montesanti, Co-Head of Private Financing Sales Europe at NatWest Markets N.V., one of NatWest’s businesses in Europe, stated DBT “shares our dedication to serve the increasing SME sector and we are glad to further support DBT’s aim and cooperate with them.”

Alexis Kopylov established DBT in Stockholm in 2017. It makes use of real-time client data and a proprietary credit intelligence technology platform to provide borrowers with personalized finance that can be scaled up quickly. Over the last six years, the platform has enabled it to lend more than SEK 2 billion ($180 million). According to DBT data, SMEs that receive financial support through loans expand on average seven times more quickly than those that do not.

DBT provides SMEs with straightforward access to growth capital by leveraging its credit intelligence platform and combining a rational tech- and data-driven procedure with human and qualitative collaboration. The corporate financing offered by DBT is intended for limited firms in all industries that require a loan of SEK 3–30 million. Notably, the Swedish Financial Supervisory Authority has registered DBT as a financial institution.

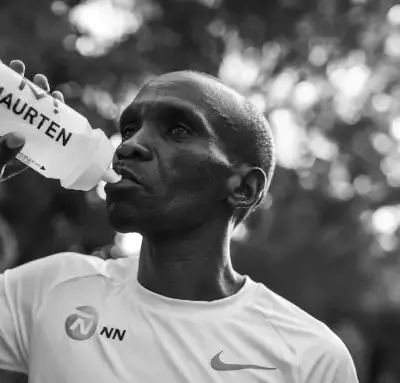

Image Credit: DBT